Choosing between an ECN and an STP forex broker is an important decision, that will have an effect on your success as a Forex trader. Both broker types are a better choice than dealer desk brokers, as they they will not act as the counterparty to the transaction, but will rather pass on your transaction onto other liquidity providers. This removes the conflict of interest that is created when the broker takes the counterpart position that is created when they earn money when you lose money. ECN and STP brokers align the interest of the broker and the trader by making sure that the broker makes more money if the trader is profitable and keeps trading. Understanding how they work is also essential to be able to choose the type that suits your trading style and strategy the best.

This article explains the plumbing behind each model, contrasts their behaviour in normal and stressed conditions, describes how costs are composed and measured in real terms, highlights the execution phenomena that matter to traders, and gives practical guidance for testing and choosing a provider that fits your style.

Once you know whether you prefer an ECN or an STP broker, you can start comparing different brokers of that type. There are many websites that can help you do this. I mainly use Broker Listings when I want to compare brokers. I use this website because they make it very easy to compare different brokers side by side. I do not have to create my own spreadsheets or browse between different pages to compare brokers. Brokerlistings.com makes it easy to find the broker that suits me the best.

What ECN and STP actually mean in practice

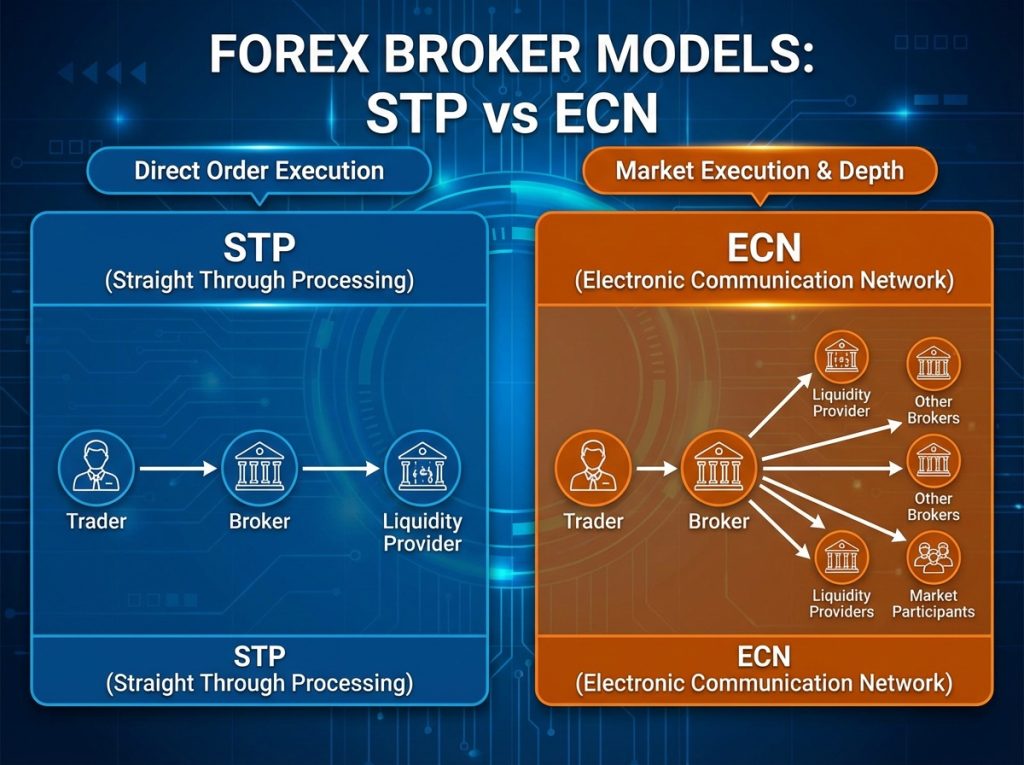

ECN stands for Electronic Communication Network and refers to an execution architecture where orders are matched against an order book or against liquidity posted by multiple participants. In classical ECN setups your order is exposed to a multi-party pool of liquidity providers and other participants; the venue matches bids and offers, and fills typically originate from visible or semi-visible depth. ECNs tend to separate spread and commission clearly: you often see raw interbank spreads and then pay a per-lot commission. STP, or Straight Through Processing, describes a routing model rather than a single venue. An STP broker aggregates price feeds from a set of upstream liquidity providers and forwards client orders to one or more of them automatically. STP pricing is usually a blended feed, the broker shows a presentation price that reflects aggregated upstream quotes plus any markup the broker chooses, and execution may be routed to different providers depending on size, latency and the broker’s internal routing rules. Conceptually ECN is an open marketplace for liquidity; STP is an automated intermediary that chooses which provider to use for each ticket.

How liquidity and pricing differ

Liquidity sourcing is the mechanical heart of the distinction. ECN liquidity is generally broader and more competitive for major pairs during liquid hours because multiple banks, market makers and other participants post firm sizes and prices into the same matching layer; the result is that at normal sizes you see narrow spreads and visible depth. STP liquidity depends heavily on the set of upstream counterparties the broker contracts with; the broker’s pricing engine blends those feeds and may add a markup. The practical implication is that an ECN often delivers consistently tight raw spreads for liquid pairs, while an STP feed may show slightly wider spreads but can be more stable across a wider range of instruments because the broker selects the best available provider for each instrument. On less liquid pairs and during low activity hours the ECN may display thin depth and larger slippage unless it aggregates many participants, whereas a well-connected STP broker can route around thin pockets by sending orders to a provider with available size.

Cost composition: spreads, commissions and the effective round-trip cost

You must evaluate cost as an all-in round trip figure in your account currency, not by looking at a quoted pip figure alone. ECN brokers typically offer raw, tight spreads but charge explicit commissions per lot; STP brokers more often include a markup in the spread and may or may not charge additional commission. Which is cheaper depends on your ticket size, frequency and target capture. For micro scalps where you target a few pips repeatedly, the commission load on an ECN can make the net cost higher unless the spread advantage is significant; for larger intraday sizes the ECN commission plus tight spread often beats a wider STP spread with no commission. A further complexity is that both models present dynamic costing: spreads widen in volatility and markup behaviour under stress may differ by model. The only robust way to compare is to compute average execution cost across representative trades for your style, include spread at time of entry, the explicit commission, and observed adverse or favourable slippage, and express the result in currency per trade and as a percentage of expected edge.

Execution quality: requotes, slippage, partial fills and fills under news

Execution quality is where operational differences show up most clearly. ECNs generally match or do not match: if there is visible depth you receive fills; if depth is absent your limit may rest or your market order may take the next available liquidity, producing slippage but rarely a manual requote. STP brokers sometimes requote or reject if an upstream provider withdraws liquidity between quote and order; that behaviour adds latency and can frustrate scalpers who need instant fills. Partial fills occur where depth is insufficient; ECNs can provide partial fills from multiple participants in one match, while STP fills may be routed sequentially and create fragmented fills or rejections. During scheduled macro events both models suffer, but the user-experience differs: ECNs may show dramatic instantaneous price moves and execute at the new level; STP brokers may widen posted spreads or temporarily refuse fills and present requotes. Traders sensitive to the last few pips should test both models across news windows and examine how stops are handled, whether they become market orders or are executed as limits, because this behaviour materially changes realized performance.

Conflict of interest, hedging and internalisation

Neither model is inherently conflict-free. An ECN is structurally less conflicted in the sense that it is a matching venue where the broker typically acts as a technology provider rather than the principal counterparty; however, many brokers route flow via ECN connections but also internalise a portion of retail flow or offer hybrid account types. STP brokers may or may not internalise; some explicitly hedge all client flow externally while others internalise smaller tickets and only route larger ones. The critical practical point is disclosure and behavior under stress: if a broker consistently widens spreads only for accounts that are losing, or if it refuses to route fills to external providers in circumstances where routing is claimed, these are red flags regardless of the advertised model. Demand routing reports, ask whether the account sits on the same pool as institutional clients, and verify that the broker hedges or routes flow in a manner consistent with their claims.

Suitability by trading style and time horizon

Different trading styles prefer different models. Traders who require the tightest possible spread for frequent intraday work and who can afford per-ticket commissions often favour ECN execution for the raw liquidity and predictable order book behaviour during liquid hours. Algorithmic traders and those using co-location or low-latency infrastructure also commonly prefer ECN or institutional STP with DMA access. Traders who prioritise simplicity, slower time frames, or broader instrument coverage may prefer STP where the broker smooths execution and handles routing, and where spreads may be slightly wider but the friction of per-ticket commission is absent. For swing traders and buy-and-hold investors the distinction is less important; custody, overnight financing and instrument availability matter more than the last millisecond of execution.

Testing a broker practically — what to measure and how long to test

Marketing claims mean little until validated in live conditions. Run a funded trial sized to the position sizes and times of day you will actually trade, and log a representative sample of trades across quiet and volatile sessions. Record the quoted spread at the time of order, the executed price, any visible slippage, whether you received requotes, and the time between order submission and fill. Test stop execution behaviour explicitly by placing protected stops in both quiet and news windows and inspect how the broker reports the execution path. Attempt a small withdrawal and a support ticket; slow or obstructive customer support is a separate but equally crippling operational risk. If you plan to scale, perform incremental size tests: increase ticket size and re-check slippage and liquidity provision because ECN and STP behaviour can diverge rapidly with scale.

Regulatory, custody and counterparty considerations

Execution architecture is only half the safety story. The legal entity you fund and its regulator determine client money protections, segregation rules and available dispute mechanisms. An ECN connection provided by a regulated entity in a major jurisdiction carries different legal fallback options than an offshore STP provider operating with little local oversight. For institutional or large retail traders the presence of independent clearing and formal liquidity agreements adds comfort; for retail traders check for negative balance protection, clear margin rules and an accessible complaints process. Execution fairness and routing parity are not substitutes for proper regulatory oversight; prefer brokers whose legal entity is clear and whose client money rules are documented.

Scaling, pricing tiers and hidden economics

As you scale, apparent advantages can evaporate. ECN commission schedules often offer tiered rebates for volume and may require meeting minimum monthly volumes to access the best rates; STP brokers may offer tighter spreads for larger accounts or on request but can also reserve best liquidity for chosen clients.

Common misperceptions and pragmatic clarifications

Many traders assume ECN always equals better prices and STP always equals worse. Reality is more nuanced. A thinly connected ECN can be inferior to a well-connected STP that aggregates deep bank liquidity. Similarly, the concession of a small spread markup in STP can buy an execution path that avoids requotes and reduces slippage for the typical retail ticket. Likewise some brokers advertise “ECN” purely as a marketing label while routing in ways indistinguishable from STP. The correct stance is empirical: validate execution with real money and insist on transparent routing documentation rather than rhetorical model labels.

What to ask a prospective broker and what to demand in writing

When you evaluate a broker ask which legal entity will hold your funds, which upstream liquidity providers are used for your account tier, whether your account shares the same liquidity pool as institutional clients, what the commission schedule and true all-in round trip cost looks like at your typical trade size, how stops are executed during volatility, and what historical uptime and outage indemnities they offer. Demand written routing policies, sample execution reports and clear withdrawal terms. If the answers are vague, request a short trial period with a small funded test and keep detailed logs; a broker that balks at a simple verification is unlikely to behave transparently once funded.